Question: I am in a same-sex de facto relationship with my partner. We are both working full time and have about two decades more before we reach retirement age. I am selling my investment property this financial year and expect to pay substantial CGT. I wish to reduce this CGT where possible. Am I able to make concessional contribution to my partner's super for the financial year 2017-18 when my property is sold? I am aware of the concessional contribution cap of $25,000 which includes his employer's super contributions, among others. Also, can I make concessional contributions for the forward financial years and if so, for how many years in the future? We each have around $200,000 in our super.

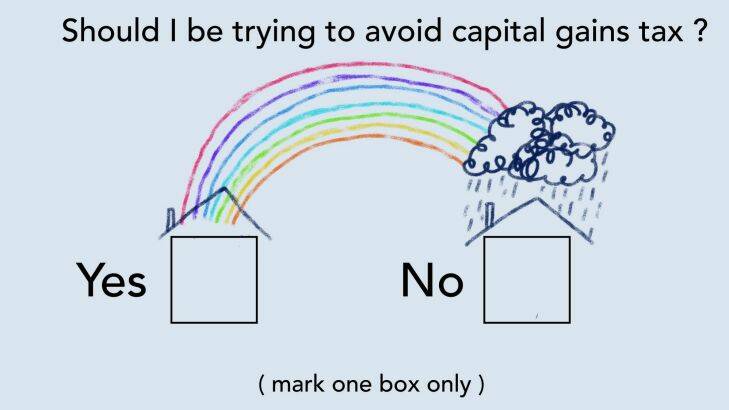

Answer. The superannuation rules are the same for everybody. The only contribution that can be made for a partner is a non-concessional one which some people make to a low-income partner to get a rebate of up to $540. This is no use to you if you are trying to avoid capital gains tax. Also, you cannot bring forward concessional contributions now, but the rules will change next year to allow catch-up contributions. Again, this will not help you if the property is being sold in the current financial year. You may wish to investigate what would happen if you deferred the sale for a few years to attempt to use the catch-up contribution strategy, but this would be of little value if your employer is contributing a large sum to super every year.

Question: l am on the disability pension and bought $5000 in shares and had it recorded on my Centrelink assets test. l had some good luck and the shares tripled in value to $15,000. If l sell them and pay the $15,000 into my bank account and have made $10,000 profit, does that affect my disability pension or the amount of pension l receive each fortnight?

Answer: Realised capital gains are not, in and of themselves, treated as income for pension income test purposes. The social security income test assesses financial investments, which includes cash, bank and term deposits, and shares, using the deeming provisions. This approach treats all financial investments consistently and a change in a person's asset allocation (e.g. sell some shares and deposit the proceeds in their bank account) would not change their total level of financial investments for social security purposes. For assets test purposes, assets including financial investments, are assessed at their net market value. Your pension should be unaffected by what you propose.

Question: Recently we have sold a holiday house and will have $600,000 to invest for about 12 months. I have looked at bank term deposits which seem to return around 3.5 to 3.8 per cent. This is obviously secure and guaranteed, but is this the best option? Could you suggest other options?

Answer. Placing the money in the bank is the only practical option. There should be no entry or exit fees and no risk of a loss of capital if markets fall. If you receive unequal incomes investigate placing the money in the name of the lowest income earner.

Question: I have an apartment valued at $550,000 and a mortgage of $470,000 which has a 100 per cent offset account attached to it. Is it better to pay fortnightly rather than monthly, or because I have a 100 per cent offset account I just keep the money in the offset account which is effectively the same thing? And then one day move the money I have accumulated in the offset account to pay down the mortgage? I was just thinking of paying monthly, and keeping the extra money in the offset account - then at some stage transferring funds across to my loan account. I am assuming this would be just as effective as paying fortnightly or paying extra into the loan if I still keep in offset.

Answer. The concept of paying fortnightly has nothing to do with timing - it works due to the fact that you pay one extra monthly payment a year without feeling it. That is because there are 26 fortnights and 12 calendar months. If your repayment is $4000 a month, and you moved to $2000 a fortnight your annual repayments go from $48,000 a year to $52,000 a year. I think using the offset account is a great strategy.